Open Banking refers to the idea of giving consumers more control of their financial data. This primarily takes the form of financial institutions opening access, to this data, to innovative new providers via APIs. These Fintech providers can then use this data to offer services to customers that simplify and reduce the costs of their financial lives.

In 2015 the European Parliament proposed a Payment Services Directive, called PSD2, which aimed to open up banking to allow innovative new services into the market.

Whilst several countries have begun to open up banking, the United Kingdom has been the fastest in actively moving forward with the process. In 2016, the financial regulators in the UK stated that all of the biggest banking providers in the country had to allow access to customer transaction details for licensed providers, and in 2018 this came into force.

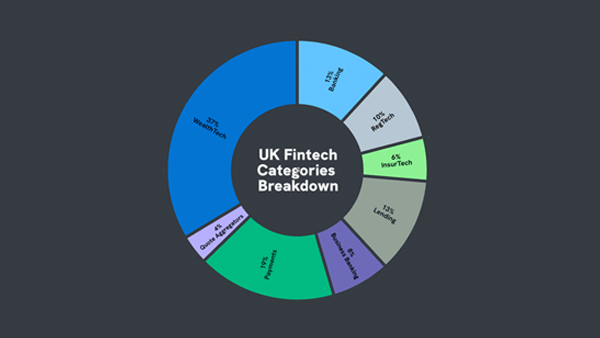

By 2020, over 200 financial start-ups in the UK have received licenses to work with the new data APIs, which has given rise to useful applications like saving and investing platforms such as Moneybox and Plum, and budgeting apps such as Emma, Moneyhub and Money Dashboard.

Even new UK banks, such as Monzo and Starling, which were not part of the initial instruction to open up their data, have begun to do so, thus increasing the amount of consumers who can take advantage of the new products.

For consumers, Open Banking has opened up a new world of possibility in managing your financial data, which will only become even better as the technology improves and more financial institutions get involved.