Fintech is a word you will probably be hearing a lot these days. Especially if you are consuming any media related to finance. In its most basic form, Fintech is a shortened version of Financial Technology. It is essentially an industry buzzword that describes mostly startup companies that operate within the financial sector. These companies aim is to utilize modern technologies to deliver financial services to consumers and businesses.

Really the best way to understand what it is, is to understand the predominant concept that has been the aim of thousands of startups since the internet really started to take over in the 1990s – disruption.

With the invention of any new technology, old industries can be totally changed or even replaced. This is disruption. For example, look at Uber. The taxi business in many countries was seriously outdated, with monopolies, inefficient booking systems and a massively devolved range of services on offer. Uber came in and disrupted the market by making the entire process far easier by using modern technology such as mobile apps, location based services, simple card based billing etc. Today, Fintech’s all want to be the Uber, (or Amazon, or AirBnB etc) of their area of finance.

What types of Fintech are there?

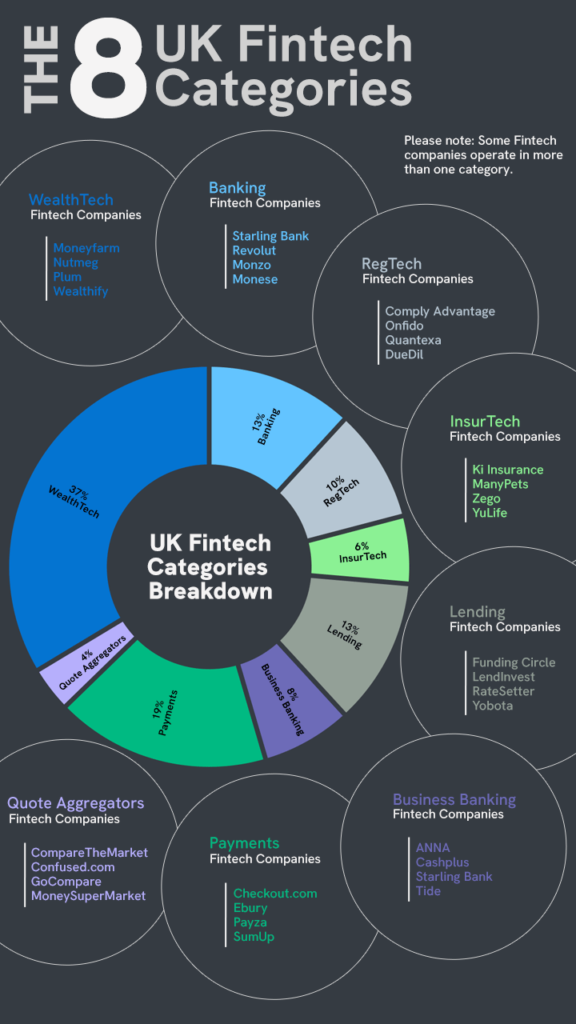

Today, the Fintech industry broken down into 8 broad categories, which are:

- Banking – Personal Banking Accounts, Mobile Banking, Digital Banks

- Business Banking – Business Banking Accounts, Invoicing

- InsurTech – personal & commercial insurance

- Lending – Peer-to-Peer lending platform, consumer lending, business lending

- Payments – online payment processes, EPOS (electronic point of sale)

- Quote Aggregators – comparison platforms for insurances, credit cards and loans

- RegTech – compliance, fraud protection and regulation technology

- WealthTech – online trading platforms, robo advisors, investment apps

Many of the Fintech companies today operate in more than one category. For example, Oak North Bank from London offer Business loans as well as personal saving accounts. SumUp is offering a payment system for businesses as well as a business banking account. Revolut offers both personal and business accounts and products that fall into the WealthTech category such as buying stock and cryptocurrency.

What are the biggest Fintech categories in the UK?

The biggest category in the fintech industry is WealthTech, which comprises of 37% of the Fintech industry.

Is PayPal a Fintech?

With the financial industries, it has taken quite a long time for startups to really move into the space. Whilst PayPal is essentially a Fintech (their business is the very essence of what Fintech is – modern technology in the finance sector), they really added a new element to the finance world, rather than actually replacing things that were already there.

Since 2010 however, many more Fintech’s have moved into the real core areas of finance. Banking, investment, insurance, trading. All have many new companies now bringing in new tech to old business models, and really shaking things up.

The industry was, and still is, definitely ready for a shake up. All of us have bank accounts, and we know all too well the old-fashioned business models. Getting letters, using outmoded online banking platforms, and waiting for ages to get through to call centres to speak to someone about our account. Not the most user friendly service!

These new Fintechs all aim to bring the technology now available to the finance space, to get rid of all of these time consuming, difficult systems.

Some examples of Fintech companies in the UK

- Starling Bank – A British bank – read our review of Starling Bank.

- Wise – An International money transfer company – read our review of Wise.

- Moneyfarm – a robo advisor investing platform – read our review of Moneyfarm.

- Revolut – a UK Fintech who operates in many areas such as Banking, Business Banking, WealthTech and Payments – read our review of Revolut covering the area of banking.

Is my money safe with Fintechs?

Whilst traditional finance businesses could often be old fashioned and slow, they did also have many years of financial regulation behind them. This did not stop there being issues with fraud or financial crashes etc. But at least there were safeguards in place, and often hundreds of years of history behind the companies.

With many of the new Fintech companies, they are startups, and as such, are often not profitable. Some customers may feel wary of entrusting their money with an entity that is currently losing money and existing from investments. However, governments and regulators in the US and Europe have been very strict in ensuring that any new financial entity is properly regulated. Therefore any funds entrusted with them are at least as safe as with the more established financial companies.