Saving is an important part of anyones financial plan, and a huge part of the financial industry in the UK. In a study from the Financial Conduct Authority (FCA), they found that UK consumers hold a staggering £1.5 trillion in savings. In this article we have collected a selection of key UK savings statistics

How much does the average person have in savings UK?

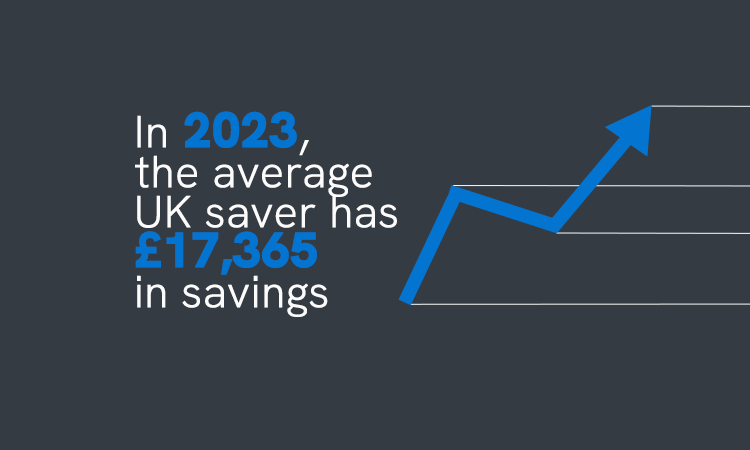

In 2023, a survey by the Building Societies Association found that as an average, UK individuals each had £17,365 in savings.

Source: BSA, Image: Hooley Media

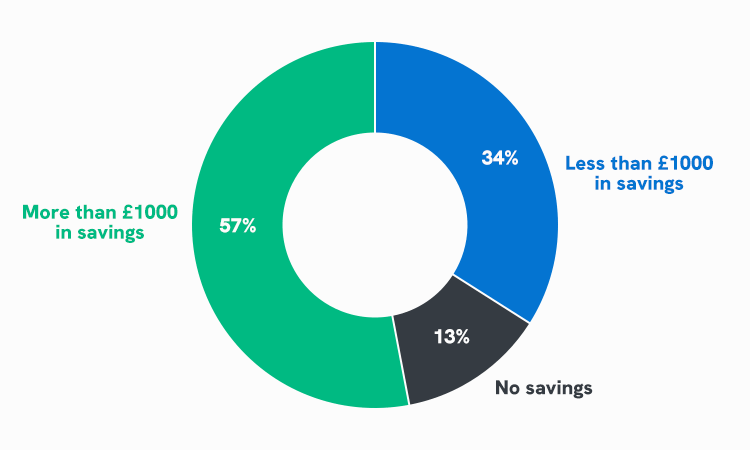

How many people have low or no savings?

Whilst around £17,000 in savings may be the average, there are unfortunately many people with a lot less, and even no savings at all. Statistics from Money.co.uk found that 34% of UK consumers had less than £1000 in savings, with 13% having no savings at all.

Source: Money.co.uk

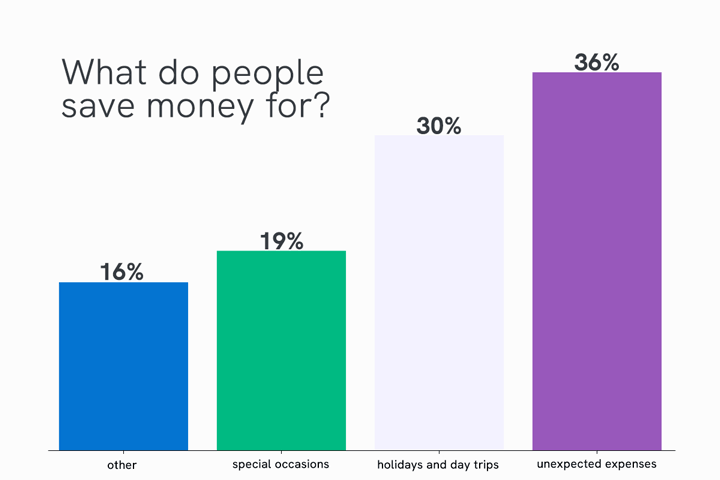

What are people saving for?

The Money & Pensions Service found that the biggest reason for saving was ‘unexpected expenses’ at 36%, which is essentially another name for an emergency fund – a super important thing to have!

Source: Money & Pensions Service

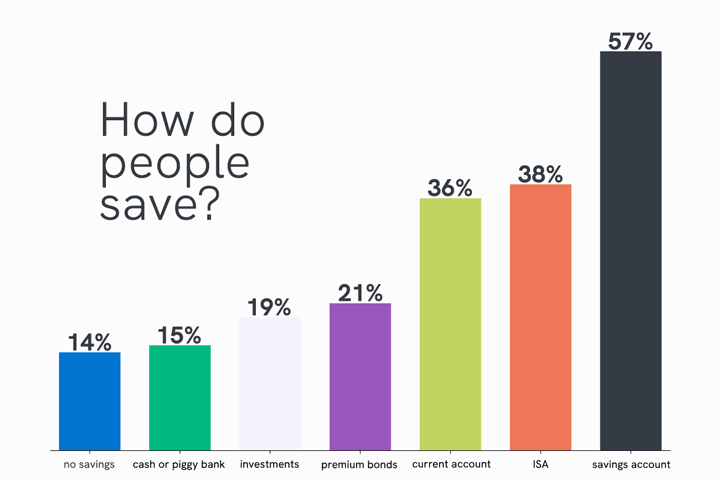

What do people use to save?

Whilst a clear majority of 57% of people use a savings account to save, and ISAs, investments and premium bonds are also popular, some may be surprised that 15% still save with cash!

Source: Money & Pensions Service

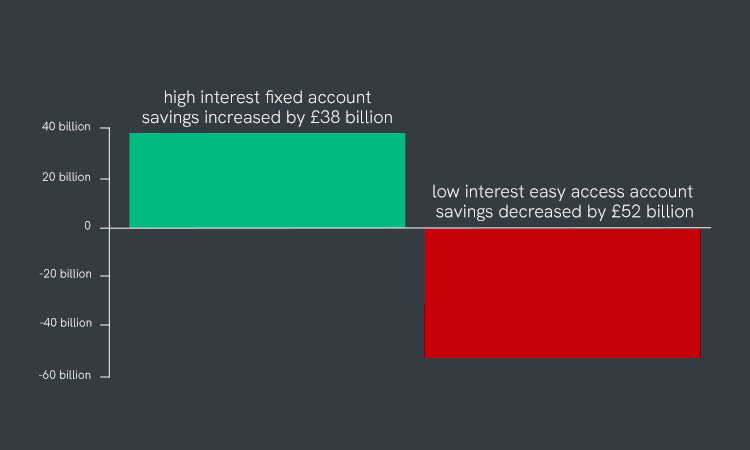

Are savers getting smarter with their savings?

There are signs that savers are choosing their provider more wisely when it comes to where to keep their savings and the level of interest they are receiving.

In a study by the Financial Conduct Authority conducted in 2023, it was found that easy access savings accounts, which generally have low levels of interest, saw a drop of £52 billion in the amounts held in them. At the same time, fixed rate savings accounts, which have higher rates of interest, saw an increase of £38 billion in deposits.

It may be that UK savers are more aware of the interest rate they are getting due to the rises in inflation in recent times.

Source: FCA

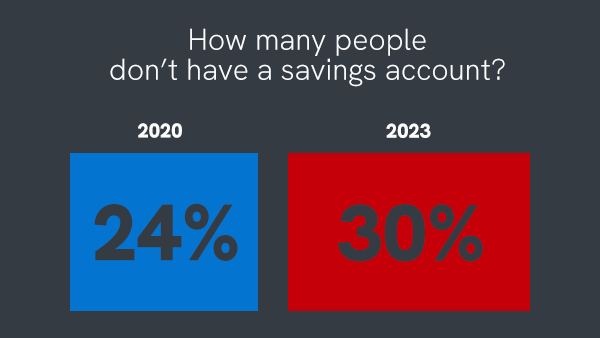

The number of people without a savings account is increasing

In 2023, 30% of UK individuals do not have a savings account, according to research from the FCA. This has increased from 24% in 2020.

Source: FCA

How much should the average person save?

The amount that a person should save depends on their personal situation, and for some it may be hard to even think about saving in the current financial climate in the UK.

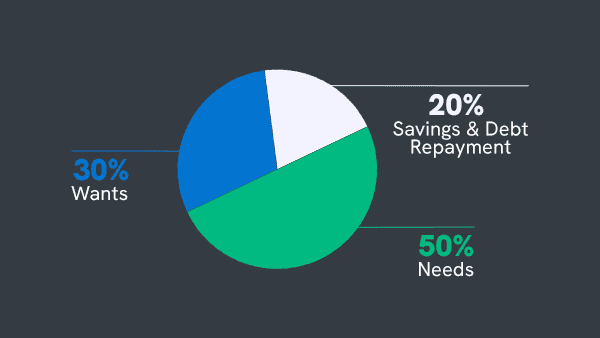

However, saving is a great habit to get into, and there are some budgeting methods that can be very effective. One of these is the 50-30-20 savings method, which breaks down your income into 3 main areas.