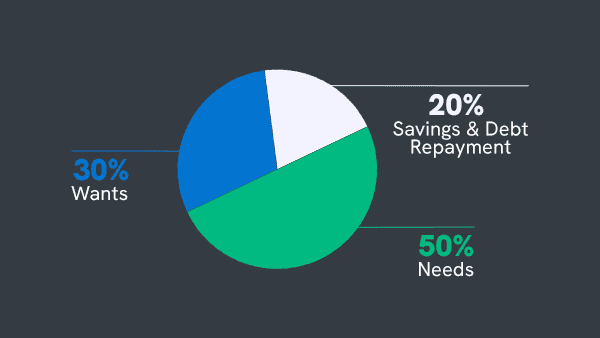

There is no ‘one size fits all’ rule or set of guidelines on how much money each person should save each month. However, the 50 30 20 rule is a good place to start.

The rule was popularised in a book titled All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren, (the Harvard law professor and US senator) and Amelia Warren Tyagi (American Business Woman, management consultant and author).

The rule stipulates that:

- 50% of our income each month should go into essentials i.e. your “needs”. These are housing, bills, insurances, transport and essential food and groceries.

- 30% should go into non-essentials such as restaurants, non-essential grocery shopping, clothes, entertainment i.e. “the wants”.

- The remaining 20% should go directly into savings or to pay off debt. This is a good guide to kick off for the absolute beginner.

Table of Contents

Building a 50 30 20 budget

The creation of a 50 30 20 budget entails separating out your after-tax income into 3 main areas:

50%: Needs

The largest chunk of your budget in the 50 30 20 rule is classed as ‘needs’. This is essentially the essential things that you must have to live, for example:

- Housing costs i.e. rent or mortgage

- Domestic bills i.e. electricity, gas, broadband, mobile phone etc

- Food shopping

- Essential toiletries

- Minimum payments on short term debt i.e. credit cards and loans

- Insurances

When you do you initial budgeting calculations, you may find that these ‘needs’ take up more than 50% of your after tax income. There could be ways to bring this number down, for example shopping in a cheaper supermarket, looking for better deals in bills and insurances etc.

However, due to the cost of living crisis happening in the UK in 2023, and rents and mortgage payments increasing, it may be impossible to bring this number below 50%. If that is the case, then you can always reduce the other percentages for the ‘wants’ and ‘savings’.

30%: Wants

‘Wants’ refers to the things in life that are not essential, but may be those things that make life worth living! Such as:

- Trips and holidays

- Subscriptions (i.e. Netflix)

- Eating out and takeaways

- Entertainment i.e. the pub or a cinema with friends

- Non-essential clothes

You may get a shock when you initially do your budget, as these things can be expensive, and you may find that they are currently taking up more than 30% of your spending! However, don’t panic, as this area is also the easiest to cut bank on generally.

20%: Paying down debt and building wealth

Finally, the 20% that remains after the ‘needs’ and ‘wants’ should be dedicated to savings and debt repayment.

You should always prioritise paying off your short term debt, such as on credit cards, loans or store cards (things such as mortgage payments are longer term debt, that has lower interest rates, so are therefore different). This is because the interest rates on these forms of debt are often very high – and definitely higher than any interest rate you get on savings. Therefore, you could end up paying more in interest on your debts, than you would be getting as interest on your savings!

Track Your Expenses

To kick off your journey towards your financial goals with the 50-30-20 rule, you first need to find out where you are. There are a number of ways you can do this. In the past it was probably best to do a spending diary, so you can pin down exactly what you spent money on over a certain period.

However, this process can be much simpler nowadays. Firstly, most payments are done with card, so there is less calculation of cash purchases. Secondly, many banks offer budgeting functions, and easy online viewing of your statements, so you can download and then keep track. You can even use a dedicated budgeting app such as Snoop, Moneyhub or Money Dashboard, which will make things a whole lot easier.

Once you have all of this data, it will make the process of setting up your 50-30-20 rule budget much easier.

A 50 30 20 rule example

So, lets look at a 50 30 20 rule budget in practice. In 2023, the average salary for a UK worker is a little under £28,000. Based on current tax levels, the take home pay on that amount would be around £1922 per month. Therefore, the breakdown for a 50 30 20 rule budget would be:

- 50% – Needs – £961

- 30% – Wants – £576.60

- 20% – Savings and debt repayments – £384.40

Now, this is of course flexible. Things are tight for many people in the UK in 2023, and rent and mortgage costs are rising. Therefore, it may not be possible to put the entire 20% into savings and debt repayment. However, if that is not achievable, then try to do 15% or even 10%. Even if you start smaller, it is important to start!

50 30 20 rule – The importance of savings

There are so many advantages of savings, not least the peace of mind that comes from having a safety buffer. Over 50% of people in the UK do not have an emergency fund in case they have unexpected expenses or a loss of income. However if you can manage to kick off with the 50 30 20 rule, then you can calculate how long it would take you to build up a good emergency fund level.

If we go back to the 50 30 20 rule budget example we created above. The 20% each month was a total of £384.40. If you saved this amount for 1 year, then you would have £4612.80 in savings.

This is approximately 2.5 x the monthly after tax income of £1922, so after just one year of savings, you would have a buffer of nearly 3 months earnings. And that is before any extra interest is added!

A bank account that gives you more control

In the last decade, the financial industry has changed enormously. A combination of new technology and updated regulation that enables this technology to work, has given consumers much more choice in a variety of different areas.

This has created ways that can help you manage your finances, create a budget, and save and invest, that simply did not exist before, so it is a great time for you to start improving your finances.

Digital Banks

For decades, the UK banking market was dominated by the ‘big 4’ banks (Barclays, Lloyds, Natwest, HSBC). Between 80-90% of UK consumers held accounts with these banks. Now things have changed. Technology has driven the rise of many digital banks and current account providers, such as Starling Bank, Monzo, Revolut, Chase Bank UK and more.

These banks operate online and via mobile apps, and don’t have branches. They use technology to allow customers to manage their money much more efficiently than the traditional high street banks – often allowing users to separate their money into different areas in there account to budget more easily.

Budgeting Apps

One innovation over the past few years has been open banking. This basically means that banks now have to give customers access to their transaction data in request. This means that external apps can now access your bank transaction data (if you allow them) and perform useful functions.

Budgeting apps can connect to all of the banks and other financial institutions that you use, and build you a complete overview of your finances. This is an incredibly useful tool, that really helps in creating your budget and having complete visibility of your financial situation, allowing you to follow the 50 30 20 rule more effectively towards your financial goals.

Savings Apps

Savings apps come in a variety of different categories. Some, like the budgeting apps, use open banking to connect to your bank account. They then use their automated systems to calculate an amount you can afford to save on a regular basis. They then move this to their platform and give you savings options. Examples of these apps include Moneybox and Plum.

Other apps, for example Raisin, give users access to many different savings account options via one platform, which can save time and be less confusing.

Investing Apps

If you go back 10 years or more, then investing was a complex and difficult thing to get into. To invest you would need to have a relatively large amount to invest, and go to a financial advisor or a stockbroker. This meant that it was mainly those with more money who could afford to invest in stocks and shares.

However, the financial technology revolution has changed all that, and there are now dozens of investment app platforms that can allow you to start investing at a low cost, or even free, and some even have minimum investments as low as £1.

Calculate your after-tax income

The percentages for the 50 30 20 rule must be based on the after tax income. Most people have a monthly income, so it does make sense to calculate your budgets on a monthly basis. If however, your incomings and outgoings are weekly, then it would be better to do a weekly budget. So, the first step is to analyse your spending habits for a month, based on your monthly after tax income.

Tax efficient savings

For the 20% section of the 50 30 20 rule, you want to ensure that you are saving in the most tax efficient way possible, so that you get the most from your monthly income and your savings.

The UK government gives various incentives for people to save money. Firstly with ISAs, all UK residents get an allowance each year (which is £20,000 in the 2023/2024 tax year). This can be divided between savings in a cash ISA and investments in a stocks and shares ISA. Any gains on these are then tax free.

In addition, savers get a tax free allowance each year for interest earned on savings. This depends on the tax bracket you are in, and in 2023/2024, the amount you can earn in interest tax free is:

- Basic Rate Taxpayer – £1000

- Higher Rate Taxpayer – £500

- Additional Rate Taxpayer – £0

50 30 20 Rule – The Bottom Line

The 50 30 20 rule for budgeting is a good way to start off with budgeting, or to optimise your existing budgeting. The most important thing with saving and budgeting is to simply get going, as the sooner you start, the sooner you can grow your security and wealth. The simplicity and accessibility of the 50 30 20 rule is it’s superpower, as it makes it possible for anyone and everyone to budget and save.

Articles on the wiseabout.money website may contain affiliate links. If you click these links, we may receive compensation. This has no impact on our editorial and any money earned helps us to continue to provide the useful information on our site.