Open banking is an innovation within the financial industry that has transformed the way many consumers and businesses operate their finances. These statistics demonstrate the impact open banking has had in recent years.

Overview:

- There are 7 million UK open banking users in January 2023. In September 2020 this number was 2 million.

- Of these, 6.25 million were consumers and 750,000 were businesses.

- 1.2 million of these users were using open banking for the first time.

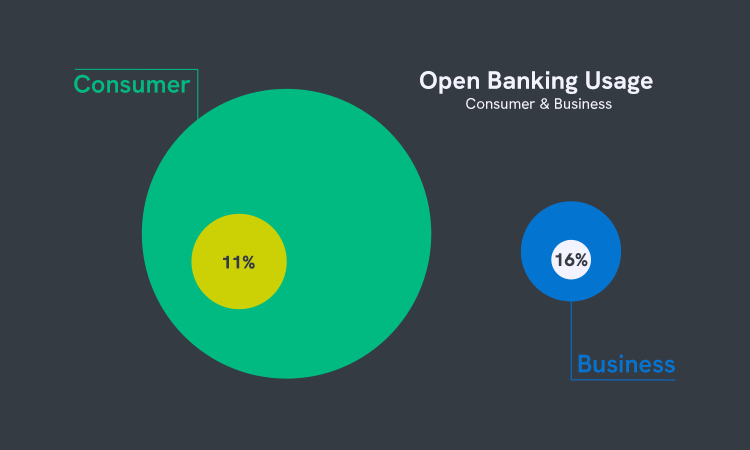

- 11% of UK consumers are using open banking.

- 16% of SMEs are using open banking.

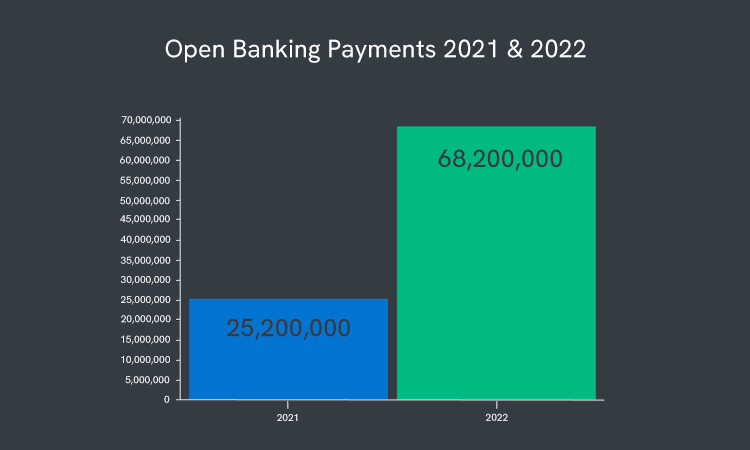

- The number of open banking transactions nearly tripled from 2021 and 2022 – going from 25.2 million in 2021 to 68.2 million in 2022.

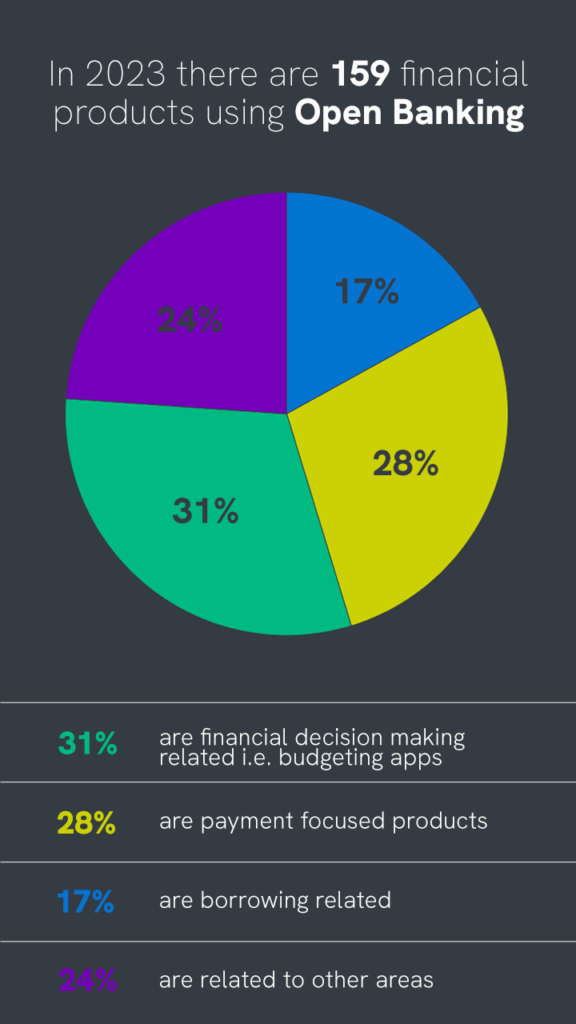

- The main types of products using open banking are financial decision making (i.e. budgeting apps), payments and borrowing.

Table of Contents

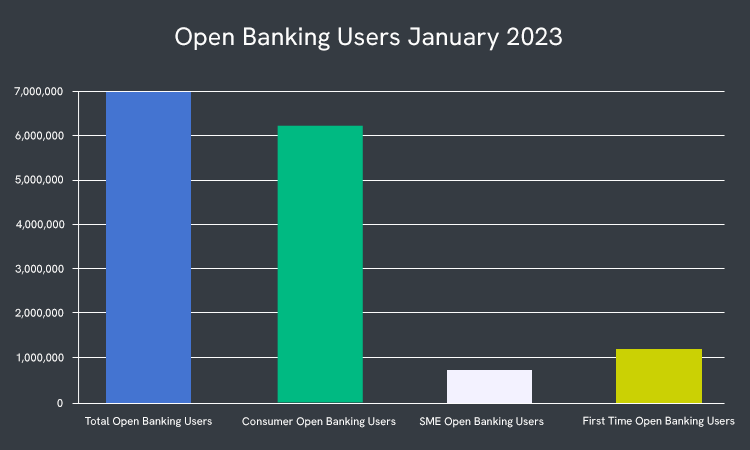

How Many People are Using Open Banking?

In January 2023, the total number of open banking users hit 7 million, with 6.25 million of these being individual consumers, and 750,000 being businesses. Of the 7 million, 1.2 million users were trying open banking for the first time.

Data Source: Openbanking.org, Image created by: Hooley Media

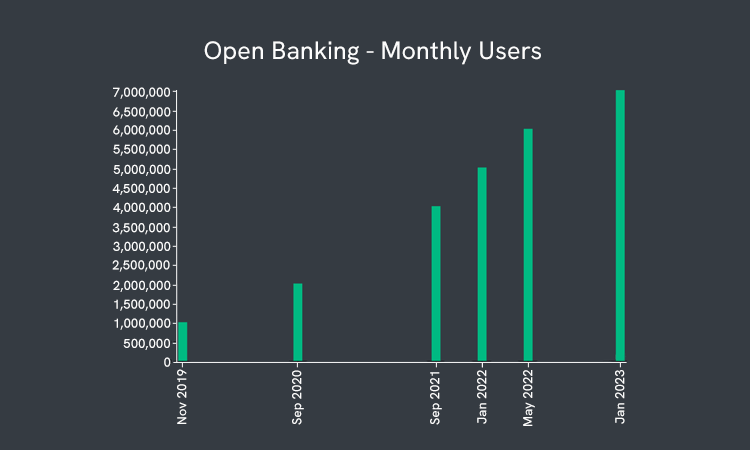

Open Banking Usage Increase Since 2019

The number of open banking users hit 1 million at the end of 2019. By January 2022, in a little over 2 years, this had hit 5 million, a tremendous rate of growth. After 1 more year, in January 2023, that hit 7 million. The growth looks set to continue as consumers and businesses see the benefits that open banking can bring.

Data Source: Openbanking.org, Truelayer

Open Banking Payments In 2021 & 2022

As the more payments providers using open banking enter the market, and more retailers offer direct bank payments as a way to pay for goods, the amount of open banking payments is likely to continue to rise sharply.

Data Source: Openbanking.org

Open Banking Penetration – Consumer & Business

Proportionally there are more businesses, at 16%, using open banking, than consumers, at 11%. This is largely because many of the most popular accounting packages use open banking to bring in the transactions from multiple financial institutions into one summary.

Data Source: Openbanking.org, Image created by: Hooley Media

Types Of Open Banking Products

The growth in the number of products on the market offering open banking services has slowed in the past year. This is largely due to several markets maturing, and multiple competitors launching. For instance in the budgeting app space there are now several different providers competing for customers.

Data Source: Openbanking.org, Image created by: Hooley Media