Key Points:

- Educate yourself about investing using the many resources available

- Focus on long-term investing

- Ensure that you diversify your investments

- Find an investment platform that suits your investment style and strategy

Table of Contents

What is Investing?

Investing is the practice of purchasing assets, in the hope and expectation that the value of these assets will rise in the future, and the value of your investment will rise.

If the value of these assets does rise, then your portfolio will grow in value. Bear in mind that it is never guaranteed, and it is always possible for the value of your investments to go down, and even to lose all of your capital.

The most common forms of investment:

- Stocks/shares

- Bonds

- Commodities

- Property

- Funds

Types of investment platforms

Traditional financial advisors

Before the fintech revolution of the past few years, traditional financial advisors were the most common way for investors to start trading assets. A financial advisor would assess an investors requirements in terms of the capital they had to invest, any investment goals i.e. saving for retirement, their appetite for risk and so on. Once they had these details they would design an investment plan, and make the trades for the customer. For beginners, a financial advisor can be a way to get expert guidance. However, some will have minimum investment requirements, plus they can be more expensive than new platforms, so may not be the best for a beginner who wishes to start small.

Robo Advisors

A robo advisor is really an automated version of a traditional financial advisor. However, they manage the design of the investment plan with their automated systems and AI. This saves on cost of labour, so these platforms can be much cheaper than a traditional financial advisor. For a beginner, they can be a good way to start, and some, such as Wealthify, have a very low minimum investment. Examples of robo advisor platforms include:

Trading apps

Trading apps, such as eToro, Trading 212 and Freetrade, have become incredibly popular in recent years, and have become the entry point for many beginner investors. Advantages for beginners include that it is generally free to make trades on these apps, and it is possible to buy fractional shares.

What are fractional shares?

Fractional shares allow users with a smaller investment budget to invest in companies that have expensive share prices. For example, Microsoft shares in June 2023 are $337 each. If you have only $500 to start investing then this is a very large chunk of your total budget! Trading apps and other platforms allow users to purchase a percentage of a share, so that they can invest in the company they want to invest in, but not take up all of their budget to do so.

One issue that beginners may face with trading apps is that they will have to decide on which shares and assets to buy. As a beginner you may have no idea where to start! One trading app that has an innovative solution to this is eToro, who have their Copytrader function. This allows you to follow successful traders on their app, and replicate their trades.

One thing to beware on with some of these apps, is that, as they are free, they have other investment products that they make more money on, that they will try to upsell their customers into using. These are mainly Contracts For Difference – CFDs, which are a complex type of investment, with a very high risk of losses. Make sure you understand exactly what you are doing with these before taking the plunge!

Examples of trading apps include:

Execution-only investment platforms

An execution-only investment platform is so-named because they provide the execution of the trade – that is, they provide a platform where you can trade, but they do not give financial advice i.e. tell you what to buy.

Therefore, beginners would need to have an idea of what assets they would wish to buy on the platforms, and create their own investment plans.

The execution-only platforms understand this, and they will provide comprehensive resources for their customers to learn more about investing and the assets they are investing in. In addition, despite these platforms not offering financial advice officially, in reality they will have many guide and best-of portfolios created by their in-house investment team that you can follow. These can be very useful for beginners. Examples of execution-only platforms include:

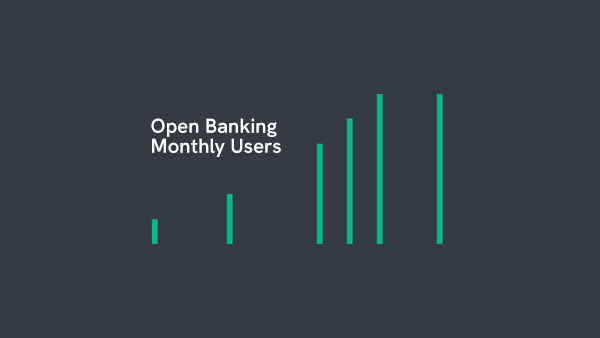

Automatic Investment apps

Automatic investment apps are perhaps the easiest way in to investing for an absolute beginner. These apps and not only focused on investment. They aim to help you budget and save, and then offer investment portfolios you can put your save money in. They will generally connect to your bank account via open banking, and calculate an amount you can afford to regularly save. They will then move this amount into their platform, and give you savings and investment options.

They are a great way to get started with investing, but the portfolio options are more limited than other platform types, so keen investors may find they want more variety and options over time.

Why invest?

There are many things in life that require money, and your goals will usually involve some of these. It could be saving up to buy a home, save for retirement, save for more expensive things like cars, or even because you want to build up an investment portfolio that you can get an income from. All of the statistics show, that if certain rules and patterns are followed, then investing is the best way to grow your capital.

With savings accounts, sometimes the interest rates are low, and sometimes they do not beat inflation. Either way, it is hard to really grow your money beyond your initial capital.

However with investing, there is decades of data that shows that the markets have grown far quicker than both inflation and interest rates, if the investment is held for a longer period of 5-10 years or more.

That is not to say that this is in any way guaranteed! There is inherent risk within investing, as with any reward comes risk. However, if you can stick to certain rules, then you have a good chance of getting a very good return on your investments. To maximise your chances of growing your wealth the best practices are:

- Ensure you have a large number of different assets in your portfolio, and that they are very diversified by country, industry and asset type.

- Invest for the long term – ideally more than 10 years.

- Ensure that fees are not eating up too much of your gains.

What can you invest in?

There is almost no limit on the amount of things that can be invested in! However, most investments fall within these categories, and are the best places for a beginner to start:

- Stocks/shares

The most commonly known form of an investment, and stock or share is an ownership stake in a publicly traded company.

- Bonds

Bonds are essentially where you lend money to an entity, in return for interest on your loan. Bonds can be corporate i.e. lending to a company, or you can also get government bonds, where the loan is to the government of a country.

- Commodities

Commodities are investments in categories of things, such as oil. Most commonly investments will be in things such as gold or silver.

- Property

A property investment is simply putting money into the purchase of property/real estate, and benefiting from any increase in value.

- Funds

Funds are a very popular form of investment, and could be the best option for a beginner investor. The funds get investment from many investors, then combine this capital and invest it in a combination of different assets such as shares, bonds, commodities and more. Each fund has a dedicated fund manager who decides the strategy. Popular funds included Exchange Traded Funds (ETFs), and index funds.

What is the stock market?

A stock market is a marketplace where stocks and shares are bought and sold. In the UK the main stock market is the London Stock Exchange (LSE) and in the USA, one of the best known is the New York Stock Exchange.

At the London Stock Exchange, they have their main market where the largest companies are traded and the Alternative Investment Market (AIM) where smaller companies stocks can be traded. Anyone can buy shares that are traded within a stock market, but not directly – you need to go via a stockbroker or investment platform.

Market Indices:

Often you will see data that shows the performance of a market as a whole, such as the FTSE 100, which tracks the top 100 companies in the UK, and the FTSE 250, which tracks the top 250. The US equivalent is the S&P500, which tracks the top 500 American companies.

The performance of these indices is often used to assess the general health of an economy. It is also possible to invest in funds that track these indices, so the fortunes of your investments follow the fortunes of these groups of companies.

Types of investment accounts/products

When you set up an account on any type of investment platform, you will need to decide on the type of account you will hold your investments in. Some of these have tax benefits, sush as an ISA or SIPP.

General Investment Account:

All investment platforms offer a general investment account, or GIA. It is the standard investment account that has no special tax status, so you may be liable for income tax, dividend tax or capital gains tax on any gains you receive on the assets you hold in a GIA.

Stocks and Shares ISA:

ISAs were first introduced in 1999 by the UK government, to encourage and assist UK citizens in saving. The work by giving an annual allowance to each individual, that they can use to either save (via a cash ISA) or invest, via a stocks and shares ISA. In the 2023/2024 tax year, the individual allowance is £20,000.

Personal Pension (SIPP):

SIPP can be used to hold investments that are in a fund for retirement. Similar to an ISA, they are subject to tax benefits.

How much money do I need to start investing?

Today, with all of the investment platform options available, investing is no longer the domain of the rich! Some investment platforms have minimum investments of just £1, although bear in mind your investment journey will be quite slow if that is all you put in on a regular basis.

Essentially you can invest with the amount you can afford and feel comfortable with. However, before you begin to invest, it makes sense to tick off the following boxes:

- Do you have any short term debt?

If you have any short term debt, such as credit cards or loans, that are incurring high interest, then it is best to pay these off as a priority before putting any money into investments. It is likely that the interest rates on these debts are higher than any return you will get on your investments, so as an overall strategy, you will gain more by paying these off first.

- Do you have some savings in an emergency fund?

It is a good idea to have a certain amount of savings in an easy to access place, for example a savings account, that you can use in an emergency. There are not hard and fast rules, but it does make sense to cover 3-6 months of spending in case of a loss of earnings.

Is investing risky?

An element of risk is inherent in any investment. There is always the chance that your investment will go down in value, and even, in extreme cases, that your investment can be lost completely. Any investor should always go into any investment understanding that their capital is at risk.

Investing is always a trade off between risk and reward.

The main factors to consider when you want to manage your risk level are:

- Diversification:

The absolute riskiest investment strategy is to focus too much on a single or small number of assets. Don’t put all of your eggs in one basket! The more different assets that your capital is invested in, and the more diverse these are, the more you can reduce your risk. It is even worth to try to spread your investments over multiple industries and countries. For example, if your entire portfolio was invested in UK companies, then an external event such as Brexit could have affected your entire portfolio. Similarly, if you were invested heavily in an industry like travel, then the coronavirus may have caused problems with your investments.

Exchange Traded Funds – ETFs, are a good way to diversify – as they are baskets of different assets. To diversify even further, you can invest in several different ETFs that had a different geographic and industry focus, which would lower your exposure to any single country, industry or company.

- Timescale:

The shorter your timescale of investing, the more chance that you will make losses. This is for a variety of reasons. One is that if you want to make a quick return, you will be looking for assets that appear to be giving a quick return, and these will often have more risk. You may also concentrate your capital too heavily on one asset, which again increases your risk.

Beginner investors should think about investing as a long term strategy to grow your wealth. Really you should think that you will invest for 5 years plus, ideally more. In general stock markets rise above inflation and savings rates over time. However, there are some years, for example the 2008 financial crash, where the markets underperform. If you have a short investment time, and one of these bad years occurs during that time, then you investment may end up being less than you put in.

In addition, the longer your investment, the more you can take advantage of the compounding effect. This means that any returns you get on your investment can be re-invested. Over a longer period of time this can have a huge effect on the value of your investments.

Most investment platforms will have ready-made investment plans that you can follow that are categorised by risk level. For beginners it can be good to follow these to start, so you can see how they build the portfolio, before you begin choosing stocks yourself.

Bear in mind however, that if you choose the lowest risk assets, they you will likely get the lowest return.

How to learn about investing

There are many ways to learn about investing, not least websites like Wiseabout.money! The internet has a wealth of information about investing, from websites like this one, to finance influencers on Youtube and social media, and even on message boards like Reddit. However, it is crucial to be very careful as there are unscrupulous individuals everywhere on the internet and with investing it is even more important to be careful.

It is a good idea to actually start investing, even in a very small way to begin with, and then take advantage of the resources that the investment platform you are using has to offer. Some platforms, such as Hargreaves Lansdown and Interactive Investor, have very comprehensive investing resources where you can learn a lot.

If you have a few stocks and shares, then you will start to keep track of the performance of them, and as you do this, you will naturally start to understand the landscape of the investing world, and also the jargon.

Investing costs and fees

There are a variety of different costs involved within investing. Some depend on what type of platform you are using, but in general the elements to look out for are:

- Platform Fee:

Every investment platform has a fee, which is an annual percentage of the total amount of investments you hold with the platform. This is the main source of revenue for the investment platform. Usually it will be in the region of 0.5%. Some platforms have fees that are flat across all investment levels, whilst others have a sliding scale, so you pay a smaller percentage the less you have invested.

- Fund Fee:

The fund fee is also an annual percentage, and is the cost of the management of funds, such as ETFs. Each fund has a different fee, so you will pay the percentage on whatever amount you have within that fund.

- Market Spread:

The market spread, sometimes known as the transaction fee, is to cover the differences between the buy and sell prices of an asset.

The above costs are often combined to come up with the total annual cost of investing. Lets look at an example:

Platform fee – 0.50%

Average Fund fee – 0.50%

Market Spread – 0.10%

Total Cost – 1.1%

This means that each year, your costs for investing will be 1.1% of the total amount you have invested. So if you have £25,000 in total held in investments, then your annual costs would be £25,000 x 1.1% = £275.

- Trading Fees

Trading fees are only charged on platforms that allow you to make a trade, such as Hargreaves Lansdown. On platforms that manage your investments, such as robo advisors Nutmeg and Moneyfarm, you do not incur this fee. These fees can be as low as zero, on some of the trading apps, to as high as £25, but on average they are between £5 and £10 per trade.

These are the four main cost areas, but there are often other costs, such as:

- Exit fees – some platforms may charge a fee if you wish to remove all of your assets from their platform – for example to move to a different investment platform.

- FX Fees – some platforms may charge a currency transfer fee if the assets you wish to buy are in a different currency than your base platform currency. For example, if you use a UK investment platform and you put money into the platform in pounds, and you wish to buy the shares from a US company, the platform may charge a fee for the transfer from GBP to USD.

- Financial Advice – if you wish to get dedicated financial advice from a platform, you would have to pay a fee for this.

Investing tips

Our top tips for beginner investors:

Invest long term

The shorter you intend to invest for, the higher the risk that you will lose money. This is because if you want to make a quick return, you will need to invest in far riskier assets. In addition, over a longer period, the markets have historically given better returns than savings accounts and have beaten inflation. However, there are some years, for example in the crash of 2008, where the returns are far less. Investing over a long period means you can avoid being hit by these bad years.

Diversify, diversify, diversify

You should aim to spread your investment as widely as possible. Invest assets in different countries, different industries, and even in different types of assets (i.e. bonds as well as stocks). The more you diversify, the more chance you can avoid a particular type of asset losing in value and affecting your entire portfolio. Funds such as ETFs can be a good way to do this.

Have an investment goal

Try to work out what you are investing for, whether to save for a new home, retirement, or to build up assets that you can get a return on that supplements your income. Once you know your goal, you can more clearly design your investment strategy to achieve it.

See investing as a way to grow, not make wealth

Try not to get seduced by the idea that you can get rich quick via investing. Investing can definitely increase your wealth and grow your capital, but it is a slow and steady process.

Ensure you take advantage of tax efficient accounts

As a priority, use any annual allowance you have that will save you tax, such as with ISAs or SIPPs.

Choosing an investment platform

There are many different types of investment platform, so you can ask yourself a few questions to discern which platform would be the right one for you:

Do you want to create your own investment strategy and do your own trades? (active investing)

If so, you should use a platform that will allow you to do so such as the ‘free’ trading apps like eToro or Freetrade, or execution-only platforms like Hargreaves Lansdown or Interactive Investor.

Do you want to leave the strategy and trades to the investment experts? (passive investing)

If this is you, then a traditional financial advisor, or a robo advisor such as Nutmeg or Moneyfarm may suit you.

Do you find it hard to put aside money to invest?

For people that find this tricky, automated savings apps can be a lifesaver, as they put aside your investment money automatically.

Do you want to learn more about investing?

If you want to grow your knowledge as well as your wealth, then using an app that allows you to make the trades will be the fastest way. Certain apps have additional resources, such as Hargreaves Lansdown with their huge knowledge base, and eToro with their innovative Copytrader function.

Overall – always remember that investing always carries risk, and there is the chance that your investment will go down in value, and even that you could lose all of it.

In any article regarding investing, you will often see two phrases repeated:

‘Your capital is at risk’

‘Past performance is not a reliable indicator of future performance’

These phrases are seen so often, that it becomes easy to just pass over them. However, these concepts are central to investing, and any beginner should always keep them in mind when starting their investment journey.

Articles on the wiseabout.money website may contain affiliate links. If you click these links, we may receive compensation. This has no impact on our editorial and any money earned helps us to continue to provide the useful information on our site.