What is investing?

Investing basically means that you buy assets, with the hope that these assets will rise in value over time, and therefore the value of your investment will also rise.

Most people have a portfolio of investments, which means that they have many different assets that they have invested in. If the value of your investments rise (or at least more of them rise than fall), then your portfolio will increase in value. A positive return on your investment is not guaranteed, and it is always possible that the value of your investments will go down, and even that you lose all of your initial capital.

Table of Contents

Common forms of investments

The most common forms of investment are:

- Stocks/shares – an ownership stake in a company

- Bonds – interest on a loan to a company or government

- Commodities – such as gold or silver

- Property – investing in real estate

- Funds – funds combine baskets of investments – for example ETFs which bundle up many different assets, usually stocks and shares

Do you need to be rich to invest?

It was maybe the case 20 years ago that you needed to have a pretty large amount of money to start investing into things like stocks and shares. But that is definitely not the case today.

Years ago, you would need to go to a stockbroker or financial advisor if you want to invest. These companies or individuals would have a pretty large minimum amount before they will work with you, and would have some hefty fees too that would eat up a small investment.

Thankfully those days are gone, and the dozens of investment platforms out there allow pretty much anyone to get started on their investment journey, even if the initial sums are small.

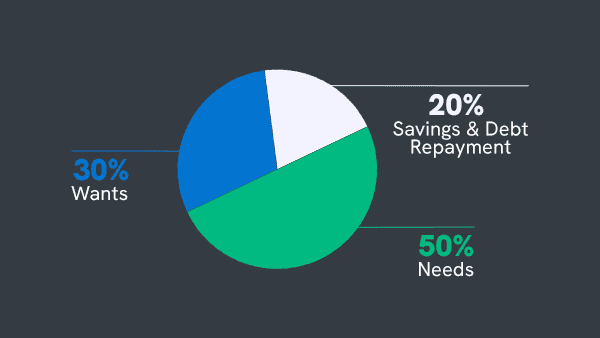

Things to do before starting to invest

Before you begin investing, it makes sense to tick a few boxes to ensure you are in the best position to do so. Some questions to answer:

Do you have short term debt?

Short term debt, such as credit cards or loans, usually have high rates of interest. These interest rates will often be higher than what you can expect to get as a return on investing. Therefore, it makes sense to ensure that you have paid off these before you allocate money to investments, as it will give you a bigger overall gain to your net wealth.

Do you have an emergency fund?

If you start investing and start getting good returns, it would be a shame to have to take all of the money out of the investments in an emergency when you needed the cash! Therefore, it is a good idea to first save up an emergency fund. There are no rules to this really, but if you have 3-6 months times your monthly costs, then this would cover a short term loss of income. Then you can leave your investments to grow.

Ok, so how much money do I actually need to start investing?

It is possible to start on many investment platforms with only £1. You will not get very far with this, but you can kick things off and open the account. You can then start to regularly put in money, say weekly or monthly, and you can then start to see progress. However, with a small investment, it will help to be aware of some key concepts:

Diversification

Any investor need to understand the concept of diversification, and a lack of diversification is a risk when investing with a small amount.

Diversification is done to avoid being overly exposed to one type of asset, as if that asset type loses value, then

Some investment platforms have a relatively high minimum investment. For example, the UK’s largest robo advisor platform, Nutmeg, have a £500 minimum investment. They state this is to avoid investors on their platform being overly exposed to certain assets – which is basically a lack of diversification.

There are many platforms however, that have minimum investments as low as £1, and it is possible to diversify your investment, even with a very small amount, by investing in funds.

Funds

A fund is a basket of assets. A fund manager will design a fund that contains many different types of stocks, shares, bonds and more. They will then attract investment to this fund. Investors into this fund will have their investment spread across all of the assets in this fund. This means that even if your investment is small, say only £50, it still has a level of diversification. A common form of fund is the Exchange Traded Fund – ETF. If an investor wants to diversify even more, they can invest into multiple ETFs that have different assets in.

Timescales

The length of time that you invest for is very important. Over a longer period of at least 5 years, and preferably more, investing in the stock market has historically provided higher returns than savings accounts. However, if you are looking to invest for a short period, say for a year, then the risks of losing money become higher.

Firstly, if you are looking for a quick return, the more likely you will choose a more volatile asset, which may appreciate more, but also carries far more risk.

Secondly, whilst over longer periods the stock market has historically given higher returns than savings interest, there are years where the stock market falls – for example after the crash of 2008. If your short period of investing coincides with a bad year, then your investment will lose money. With longer term investing the market has time to recover.

Regular investing

Most investment platforms will allow you to invest a monthly amount, that is even as low as £1. Although that is rather low and you won’t amass much from that, it is possible that you can start to accumulate larger amounts over time with £10, £20 or £50 per month. Sometimes it just makes sense to get started with what you can afford, and then increase over time as you can afford to invest more.

Compounding

A very powerful factor with saving or investing, is compounding. Essentially it means that you re-invest the returns on your capital, so it adds to the growth.

In summary, it is possible and worthwhile to start investing with as little as £10 per month, and if you can grow that regularly invested amount over a longer investment period of 5 to 10 years +, then combination of market returns, regular investments and compounding can give you a good result.

Investment platforms

Technology has driven a revolution in investing, and made it far easier for those with a small budget to get involved. The main types of investment platform are:

Robo Advisors

A robo advisor is like an automated version of a traditional financial advisor. They find out your goals for investing, then create an investment plan for you. It is a passive investment system, which means you just sit back and let them do the work! Some robo advisors such as Nutmeg and Moneyfarm have quite high minimum investments of up to £500. However with Wealthify you can get started with just £1.

Trading apps

Trading apps that allow users to do their own trading with no trading fees have become very popular in recent years. Apps like eToro and Freetrade have a low barrier to entry, and allow the purchase of fractional shares. This means that if a company stock costs £250, then you can just buy 10% of a stock, so for £25 you can invest in your favourite companies.

Execution-only investment platforms

Execution-only platforms allow you to execute trades on their platforms, but do not give financial advice – hence the name. These platforms will charge for each trade, and the price per trade can be around £5 to £10. Therefore these may not suit some investors with a small initial amount to invest as their capital will be eaten by fees.

Automatic Investment apps

Automatic savings apps will have a very small minimum investment – usually £1, and make investing very easy, as they connect to your bank, calculate an amount that you can afford to invest, and then move it into their platform – all automatically.

Minimum investments

Different investment platforms have different levels of minimum investment. We have detailed these in the table below:

| Platform Type | Minimum Investment | |

| Freetrade | Trading app | £1 |

| Moneyfarm | Robo advisor | £500 |

| Nutmeg | Robo advisor | ISA, GIA, SIPP – £500 LISA, Junior ISA – £500 |

| Interactive Investor | Execution-only | £25 per month |

| AJ Bell | Execution-only | £25 per month |

| eToro | Trading app | $10 |

| Hargreaves Lansdown | Execution-only | £25 per month |

| Wealthify | Robo advisor | £1 |

| Moneybox | Automatic Saving | £1 |

| Chip | Automatic Saving | £1 |

| Plum | Automatic Saving | £1 |

Investment products

Every investment platform will offer a similar range of products that you can use to hold your investments. Some of these, like ISAs and SIPPS, have tax benefits.

General Investment Account:

A general investment account, or GIA, is the standard investment account offered by a investment platform. It has no special tax status, so you would be liable for income tax, dividend tax or capital gains tax on any gains that you get on the assets that you hold in your GIA.

Stocks and Shares ISA:

First introduced in 1999 by the UK government, ISAs were designed to encourage the UK public to save and invest. Every UK resident gets an annual allowance (which is £20,000 in the 2023/2024 tax year) that they can use to save via a cash ISA or invest via a stocks and shares ISA. The interest or gains on these amounts then do not incur tax.

Personal Pension (SIPP):

SIPP can be used to hold investments that are in a fund for retirement. Similar to an ISA, they are subject to tax benefits.

Articles on the wiseabout.money website may contain affiliate links. If you click these links, we may receive compensation. This has no impact on our editorial and any money earned helps us to continue to provide the useful information on our site.