Building up your savings is always important, but at times when things may be a little more uncertain, it is even more important, even if it may be harder to save. Whilst saving for things like special occasions or holidays is always worthwhile, building up an emergency fund is crucial, to ensure you are safe even if problems do come up.

In 2023 it is also important to look for the best deal for your savings, as inflation is high, so the value of your savings will decrease in real terms. Even if the rate of interest is lower than inflation, it still makes sense to seek out the best deals you can so that you money does not lose too much value during high inflation times.

Indeed, it does look like UK consumers are seeking out better deals. In 2023, a study by the Financial Conduct Authority found that the amount of savings held in low interest easy-access accounts had declined by £52 billion, while assets held in higher interest fixed-rate savings accounts had increased by £52 billion.

So – how much does the average person have in savings in the UK in 2023?

A survey by the Building Societies Association conducted in 2023 found that on average, UK individuals each had £17,365 saved.

Source: BSA

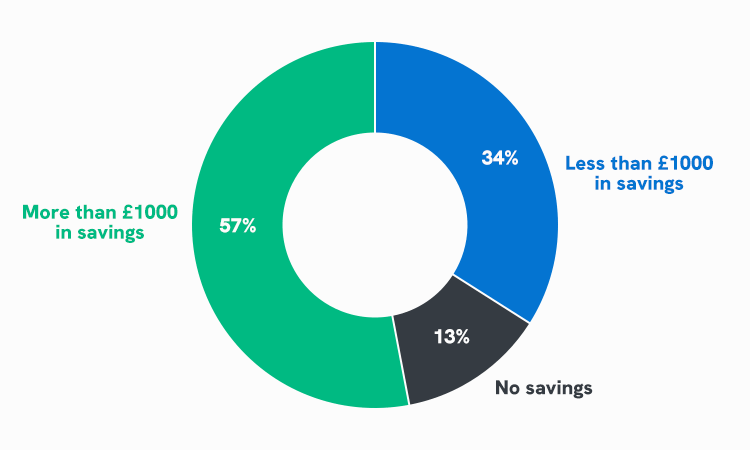

How many people have low or no savings?

The average savings is around £17,000 per person, but of course that is an average, which means a lot of people have a lot less! A study by Money.co.uk discovered that 34% of people in the UK had less than £1000 in savings. 13% have no savings at all.

Source: Money.co.uk

See our comprehensive UK savings stats 2023 article for more data on the UK savings market and environment.