Curve Card – In Brief

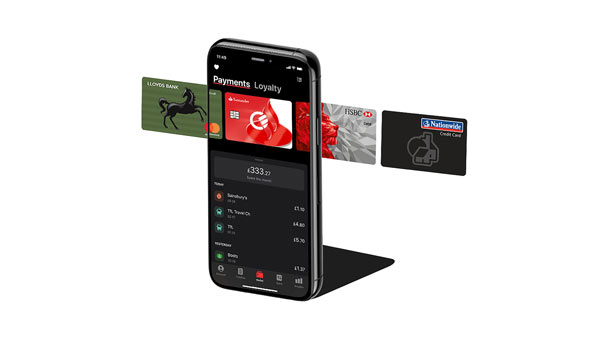

The Curve card is designed to be the only card you need to carry with you, as unlike other cards, it is not associated to a bank account, or a credit card provider. Rather, you connect all of your other cards to the Curve app, whether credit or debit cards, and then you can pay with the Curve card, and choose which of the underlying cards you wish to use for any particular payment. It is an innovative addition to the UK digital banking market.

Table Of Contents

Curve Pros & Cons

Pros:

- Curve gives you the ability to empty your wallet of all other cards and just carry one.

- Simple to use app.

- Merchants never get your actual card details.

- You can manage all of your payments after they are already made, and even move to different cards for 30 days after the payment.

- Curve Blue has no monthly fee.

- Curve offer payment protection insurance.

Cons:

- It is not currently possible to use American Express cards with Curve.

- Curve is not a bank and does not offer accounts, so you cannot use it to replace your existing banking arrangements.

- Payments not protected under Section 75 of the Consumer Credit Act.

What is Curve Card?

The Curve card is essentially a Mastercard debit card, which is controlled by a smartphone app. Curve is in many ways like Apple Pay or Google Pay, but in a card form. You simply add all of your Mastercard and Visa debit and credit cards to the app, and then you can choose which of these cards you use for a payment for each purchase you make. This means you only need the Curve card with you, but you have access to all of your cards.

The Curve card was launched in 2016, and as of 2021, they claim to have over 500,000 card holders. Currently available in the UK and the European Economic Union (EEA), Curve intend to launch in the USA in the near future.

Curve Card Features

- Add any card to the Curve app – Visa and Mastercard accepted

- Go Back In Time – change the underlying card you made any payment with for up to 30 days.

- Instant notifications – for any card activity

- Payment categorisation – within the app

- Anti-Embarrassment Mode – if a payment is declined, Curve will automatically pay via your designated fall-back card

- Metal Debit Card – available on the Curve Metal plan

- Make any card mobile ready – if a card is not compatible with mobile payment services such as Apple Pay or Google Pay, you can still use Curve to pay

- Add loyalty cards – add loyalty cards such as the Tesco Clubcard to the app

- Use card abroad – wherever Mastercard is accepted

- Curve Flex – Curve’s Buy Now Pay Later product

- Fee-free sending abroad – avoid hidden fees

- Curve customer protection – get purchases protected by Curve

Curve Blue

Curve Blue is the free tier, and as such there are less extras on offer. However, with Curve Blue you still get:

| Curve Customer Protection | up to £100,000 |

| Go Back In Time | 30 days, up to £5000 |

| Low Currency Transfer Rates | up to £500 per month |

| Fee Free Foreign ATM Withdrawals | up to £200 per month |

Curve Black

Features:

| Curve Customer Protection | up to £100,000 |

| Go Back In Time | 30 days, up to £5000 |

| Low Currency Transfer Rates | unlimited |

| Fee Free Foreign ATM Withdrawals | up to £400 per month |

PLUS: 1% Cashback on up to 3 selected retailers and Worldwide travel insurance.

Curve Metal

Features:

| Curve Customer Protection | up to £100,000 |

| Go Back In Time | 30 days, up to £5000 |

| Low Currency Transfer Rates | unlimited |

| Fee Free Foreign ATM Withdrawals | up to £600 per month |

PLUS: 1% Cashback on up to 6 selected retailers, Worldwide travel insurance, Mobile Phone Insurance, Airport lounge access and a metal debit card

Who is Curve Card for?

Curve’s aim to simplify your financial life. Instead of having multiple debit and credit cards which you have to carry around, you can just connect all of your other cards to the Curve card via their app, then just have the Curve card with you when you are out and about. Therefore, the Curve card is definitely attractive to people with small wallets!

In addition to that, Curve can really make life easier if you have multiple cards, and you want a way to easily manage which payments come out of which. With the ‘Go Back In Time’ function, you can even change which card is used retrospectively, so the flexibility is great.

Curve can also be very useful for self-employed and business owners, as you can load up both your personal and corporate cards on to the app, and then choose which one to pay with. You can even connect the accounting software Xero, to make the process even easier.

Curve Card Costs & Fees

The 3 tiers of Curve have different monthly fees:

| Curve Blue | Free |

| Curve Black | £9.99/month |

| Curve Metal | £14.99/month |

Is Curve Card Safe?

Curve is not a bank, and does not at any time hold your money. Therefore, you do not have to worry about your funds.

In addition, a great advantage of Curve, is that merchant that you purchase from never gets your actual credit or debit card details, but rather the Curve card details, which greatly reduces the risk of fraud.

With Curve, any payments that you make with a Curve card are seen as being made via a 3rd party. Therefore, if you pay with your Curve card, and use a credit card as the underlying payment method, you will not be covered by Section 75. This is essentially the same as if you were to pay via other payment providers such as Paypal whilst using a credit card to fund the purchase.

Curve explain all of this here.

Section 75 does not cover debit cards, so if payments are made with the Curve card with a debit card underlying the card, then your rights would be the same.

Curve Card Customer Reviews

Curve has a rating of 4.1 out of 5 on Trustpilot, from over 8,000 reviews. 70% of these reviews are rated at 5 out of 5, and these customers praise how easy Curve is to use and how it makes life easier by only having one card to carry. 13% of the reviews are 1 out of 5 stars. These customers appear to be unhappy with Curve customer services.

Curve Card Comparisons

Which is better – Curve or Monese?

| Curve | Monese | |

| Pricing | Free | £9.99 | £14.99 monthly | From free to £14.95 |

| ATM Withdrawals | Free up to limit, then 2% | £1.50 charge on Free and above limits |

| Safety/Security | Curve Customer Protection | Deposits NOT protected under FSCS |

| Extras | Metal Card | GBP and EUR account |

Which is better – Curve or Revolut?

| Curve | Revolut | |

| Pricing | Free | £9.99 | £14.99 monthly | From free to £12.99 Details |

| ATM Withdrawals | Free up to limit, then 2% | Free with limits Details |

| Safety/Security | Curve Customer Protection | Deposits NOT protected under FSCS |

| Extras | Metal Card | Many options Details |

Curve Card FAQ

What is Curve Flex?

Curve Flex is Curve’s Buy Now Pay Later (BNPL) product. They allow you to choose any transaction you have made with the Curve card over the previous 12 months, and get a refund for that amount. You will then be able to choose to repay that amount in 3, 6, 9 or 12 installments, with the first repayment coming 30 days later. Curve customers will have to undergo credit and affordability checks before being approved.

Is Curve a debit or credit card?

The Curve card is a Mastercard debit card. However, you can use underlying cards as the payment card you use for any Curve payment, and these can be credit cards.

Is it worth getting a Curve card?

Curve has many features and benefits that can make your life easier financially, so there is a good chance getting one would be worth your while.

Curve Card Verdict

A unique and innovative product, Curve have found a way to distinguish themselves within the ever more crowded Fintech market, by offering a handy way to simplify your financial life. If you have more than 1 credit or debit card (and most of us have far more than that!) then Curve is definitely worth looking into further.

Articles on the wiseabout.money website may contain affiliate links. If you click these links, we may receive compensation. This has no impact on our editorial and any money earned helps us to continue to provide the useful information on our site.