Its never too late to start investing and planning for a better future

The past year has taught me a thing or two about money. In particular, how little I actually need to survive, and how much I have previously spent on things that I either didn’t need, that didn’t help me, or even make me feel good beyond a few fleeting moments.

I won’t stay indoors forever, but pre Corona, I spent the equivalent cost of a home cooked meal for 4 by the time I arrived at work. Coffee, snack, and public transport (if I wasn’t cycling that day) 5 days out of 7 each week, added up to a substantial amount by the end of the month. The spending continued into lunch time, and ended on the way home when I bought something quick and convenient to prepare for dinner while my (too arduous to prepare) vegetables were rotting in my fridge. It’s hard to chop salad at the end of a long day of sitting hunched over at a desk!

Consumption (whether TV, internet, shopping) was always a form of avoidance for me. Corona forced me to live differently, and this started me thinking; I realised that I was way too careless with my finances in recent years. Therefore, I devised myself a plan to save more money:

1) Setting a budget

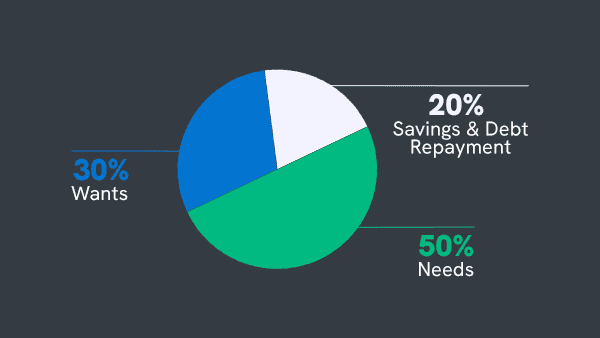

How much is needed per month to survive? I mean the essentials. Rent, food, bills, subscriptions. Note down all costs. Then add 10% as contingency. The final sum is the total monthly budget that should cover everything that is essential.

2) Open a separate bank account

Once you have the budget, you will see how much is left at the end of the month once deducted from your net (take home) earnings. Put 70-80% of what is left away into a separate bank account. This is going to be your investment money. These are your funds for which you need to go out and look at investment options. If you are unsure at all about investing, save the money for now anyway. You can go out and learn about savings plans and investments once you have gathered more information. The point is, to get the process going of regularly putting money away. You should still have money left over in your debit account every month. This is for holidays or sudden expenses, like repairs, bills etc.

3) Plan your grocery shop

Never go grocery shopping without a plan of the meals you want to cook for the coming week. I did it time and again. If I didn’t have a plan or an idea of what I was going to cook the next week, I would buy all sorts of things that sometimes didn’t even go together. Also, if you find that you cannot keep to your budget when grocery shopping because you are getting lured into buying offers and interesting new exotic foods like I do, then buying your food online and getting it delivered is a good option, because you will see how much you are spending. This way you’ll never go over budget. Finally, never go grocery shopping when you are hungry!

4) Don’t do too many top up shops for food

Don’t do more than 1 top up shop. I remember a time when I went on a big shop a week and then still did small shops 5 out of 7 days a week! Plan Step 3 and only do a top up shop for fresh fruits and vegetables if necessary.

5) Borrow clothes for special occasions instead of buying new ones

Don’t get new clothes just because big events or other special occasions are coming up. Rent or borrow items instead if you really do not have anything to wear. Most often than not everyone has items that can be worn instead. The point is that if you feel the pressure of an event, it’s very likely that you buy an item that you only will wear once. Best is to plan ahead, and only buy items that are versatile. Never panic buy. These items will land in landfill. Bad for your wallet, bad for the environment.

6) Don’t buy anything just because its cheap

Sometimes it’s cheap for a reason. Even if it’s a super fancy designer, too good to be true, item that is 70% off. THE deal of a lifetime. I have been there before. What a deal! I must buy it because I will never ever get it at that price again. But ask yourself, is it the price tag or the item that makes it attractive? Good questions to ask are: is it my style, does it fit like a glove, does the color work within my wardrobe?

7) Make sure to pamper yourself

Set aside a budget to pamper yourself. After all, life is all about having fun too. If you just save and save and deprive yourself, you are more likely to crack and deviate from your plan. Stop the yo-yo effect and budget in some indulgences.

8) Cancel any unused memberships

No point in paying for something you don’t use and have no desire or will to do so in the future.

9) Set goals for the future

Write them down. On paper. Make them stick and take actions to get there.

Be patient and stay consistent

If you lose the path, just find it again and continue on it. Don’t beat yourself up for failing, it will never go 100% according to plan. Things cannot always be planned with complete accuracy. Its normal! Don’t let small setbacks get in the way of your plan.

Remember: everyone can do it. Everyone can save, regardless of income. All that is necessary are some adjustments, the willingness to change habits and persistence in following the plan.