Table Of Contents

Chase Bank UK – In Brief

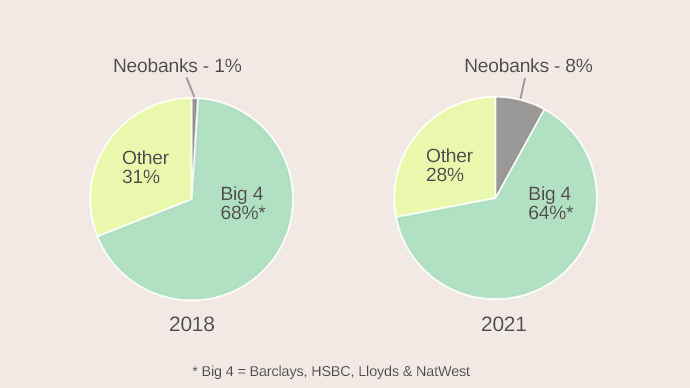

The UK digital banking space is super competitive, but Chase Bank have decided to launch their consumer banking offer here, as they clearly believe that they can siphon off some customers from both the traditional UK banks and the UK’s digital app-based banks.

Their offering certainly has attractive features, such as fee-free banking, 1% cashback on debit card purchases, and a savings account option with decent interest rates, amongst other things.

Chase Bank UK Pros & Cons

Pros:

- No fees for the current account.

- 1% cashback on all debit card spending (with some exceptions)

- Saver account with competitive interest rates.

- Simple to use smartphone app

Cons:

- Money management tools more complicated than with some competitors

- No overdraft feature available

- No joint current accounts available

What is Chase Bank UK?

Chase Bank current account is a smartphone-app focused current account. Chase are a fully licensed UK back (so deposits are covered under the FSCS), and customers can benefit from fee-free banking and various other perks.

Chase Bank UK Features

Fee-free current account – no monthly or event based fees

1% cashback – on debit card spending for first year

Round-Ups feature – pays 5% interest on your saved money

Direct debits and standing orders – set up via the app

Set up multiple free accounts – to help manage your money

Free ATM withdrawals – in the UK and abroad

Cash Deposits – not currently available

Money Management – set budgets and see spending overview

24/7 customer service – chat or call at any time

Numberless debit card – great for extra security

Cashback Exclusions: The 1% cashback offer for 1 year can be attractive, however bear in mind that there are certain debit card payments that are excluded from this offer, such as cash withdrawals, cryptocurrency payments, tax payments, financial services and more. See the full list here.

Round-Ups: If you open a free Round-Ups feature via the app, Chase Bank will round up all payments to the nearest pound, then move the difference to your Round-Ups account. For example if you buy something for £3.75, then 25p would be transferred into your Round-Ups account. Once in the Round-Ups account, Chase will pay 5% interest on this balance. The total Round-Ups amount must be transferred into your main account once per year however, so it cannot be used for long term saving.

Money Management: Users of app based banks like Starling Bank or Monzo may be used to being able to set different sections within their account to save or separate money for bills. Chase Bank do it slightly differently, giving customers the opportunity to open as many free current accounts as they wish, so they can use one for every day spending, one for bills, one for subscriptions etc.

Who is Chase Bank UK for?

Chase Bank’s UK digital current account is only open to UK residents who pay tax in the UK. Users have to be over 18 years old, and have a smartphone with a UK number.

The Chase Bank digital app-based current account could be very attractive to users of traditional banks who want to make their banking simpler. In addition, the fee-free banking, cashback and good interest rates could attract those who have already moved to an app bank but want to try out something new. Potentially however, the Chase Bank product is too similar to many existing banks out there to be able to tempt too many new users to them.

Chase Bank UK Costs & Fees

Chase Bank is free to use – it has no monthly fees, or fees and costs for any actions within your account.

Is Chase Bank UK Safe?

Chase Bank is a fully licensed UK bank, which is regulated by the Financial Conduct Authority. This means that customer deposits are covered under the Financial Services Compensation Scheme (FSCS) up to £85,000 per customer, in case the bank fails. This is exactly the same level of cover as other more long-standing UK banks.

In terms of security, Chase Bank is one of the biggest banks in the USA, and as such they have all of the highest level data encryption and security.

Chase Bank UK Reviews

Chase Bank have a rating of 4 out of 5 from around 3500 reviews on Trustpilot. Of these reviews, 66% give the highest rating of 5 out of 5. These happy customers praise the easy to use app, responsive customer services, and the cashbank offers. 18% of the reviews give the bank 1 out of 5, the lowest score. These dissatisfied customers complain about difficulties with the ID process when signing up, and issues with customer services.

Chase Bank UK Comparisons

Which is better – Chase Bank UK or Revolut?

| Chase Bank UK | Revolut | |

| Pricing | Free up to limit, then 2% | From free to £12.99 Details |

| ATM Withdrawals | Free | Free with limits Details |

| Safety/Security | Deposits protected under FSCS | Deposits NOT protected under FSCS |

| Extras | Cashback, Savings Account | Many options Details |

Which is better – Chase Bank UK or Monzo?

| Chase Bank UK | Monzo | |

| Pricing | Free up to limit, then 2% | From £5 – £15 |

| ATM Withdrawals | Free | Free in UK, 3% abroad if over limit |

| Safety/Security | Deposits protected under FSCS | Deposits protected under FSCS |

| Extras | Cashback, Savings Account | Many options |

Which is better – Chase Bank UK or Starling Bank?

| Chase Bank UK | Starling Bank | |

| Pricing | Free up to limit, then 2% | Free |

| ATM Withdrawals | Free | Free UK & Abroad |

| Safety/Security | Deposits protected under FSCS | Deposits protected under FSCS |

| Extras | Cashback, Savings Account | None |

Read our full Starling Bank Review

Chase Bank UK FAQ

Can I open a Chase Bank account in the UK?

Since late 2021, yes you can. Chase Bank launched their app and are now aggressively trying to attract UK customers with some attractive offers.

Can I pay cash into my Chase account UK?

No, Chase UK do not allow current account holders to pay in cash. If you wish to pay in cash to your account, it may be better to use a bank that has branches. However, if you still want an app based bank, Starling Bank do allow customers to pay in cash.

Is Chase Bank UK like Monzo?

Chase Bank UK is similar to Monzo in that they are both very simple smartphone-app based bank accounts. Monzo does have many more extras, but also more costs. Probably the most similar UK bank to Chase is Starling Bank, as both aim to offer a simple banking service, and are fee-free.

Does Chase UK have fees?

No – Chase Bank have no fees, either monthly fees, or fees for specific things within your account, so you can do your banking for free.

Chase Bank UK Verdict

The UK digital app based banking market is very busy and competitive, with large players like Starling Bank and Monzo having gained millions of customers in the last few years. Chase Bank have decided that their clout as one of the USA’s biggest consumer banks has given them the experience and funding to be able to make waves in the UK market. Their fee-free offering is attractive, and they have put together some interesting offers such as the 1% cashback for 1 year, and 5% interest on round-ups. Overall, their offering is not massively different than what is already on the market, so time will tell whether this American banking giant can get a foothold in the UK.

Articles on the wiseabout.money website may contain affiliate links. If you click these links, we may receive compensation. This has no impact on our editorial and any money earned helps us to continue to provide the useful information on our site.